Additionally, this procedure enables you to spend people no matter whether it’lso are consumers at the bank. If you would like purchase as you travel otherwise store global on the internet, you are better off having a wise account and card. You could hold and manage dozens of currencies in your account – all from the mobile – and make bodily and mobile payments along with your linked cards. Go shopping along with your debit cards, and you may bank away from almost everywhere by mobile phone, pill otherwise computer and most 15,one hundred thousand ATMs and 5,one hundred thousand twigs. We’ve shielded the options if you want to make use of your mobile phone within the an actual shop. But what if you just want to pay back the pal for lunch, or accept the newest cable services bill with your roommates?

By paying online as opposed to writing a, their fee is canned quickly. You could potentially prevent eventually spending the money to the commission ahead of a check are eliminated. You usually is install repeating money from the utility, rental, or loan company. Really organizations offer the accessibility to signing up for an automated write otherwise arranged fee. It’s always best to create an automatic draft just with expenses which might be consistently an identical each month. Establish automated payments for your debts that are a place number each month.

First revealed in the uk by Barclaycard inside 2007, contactless costs provides rocketed in the last 17 years. As much as a third of all the payments in the uk are https://livecasinoau.com/isis/ actually contactless, based on British Money, having 87 percent of people and then make contactless repayments at least once per month. By the end from last year, contactless costs accounted for 63 percent of all the mastercard and you may 75 percent of all debit credit deals.

Simply download the new software, check in with your PayPal account information or install a good the new account, and you may faucet “In store” for the house display screen. Whilst it’s getting more wider-spread each day, never assume all locations accept mobile purses. The brand new software is free to use and just has to be regarding their debit otherwise bank card.

Tips Post and Do Commission Requests

If your cellular telephone is actually forgotten otherwise taken, instantly block your cards on the software and make contact with their bank. Use the place or secluded rub have (See My personal new iphone, Google Come across My personal Unit) to protect yours and you will economic study. To own profiles trying to find independency, particular programs will let you put loyalty cards, plan out expenses by the group, as well as take off notes that have one to simply click once they locate a great suspicious deal. We think privileged getting greeting to the our very own customers’ organizations, and then we try and provide private solution and you may romantic cooperation during the any project.

- There is certainly that it software pre-installed on all the Apple’s previous things (ranging from iphone 3gs 6 and later), the newest cell phones try provided that have NFC technical.

- If you wish to get an upgrade from old cash and you may notes however’re new to app-founded costs, remember that they’s safe and easier to score install than you might imagine.

- When you’re playing with a third-team service, the process to possess starting money was comparable.

- Observe that last round area — that’s where your mobile service comes in.

Really financial help to own paying costs exists from the mode of subsidies for specific costs as opposed to inside the cash. Yet not, you happen to be entitled to passions assist with offer bucks service. If you possibly could’t shell out a charge card statement, pose a question to your bank card company if they leave you a split to your percentage words. If you possibly could demonstrate a purpose to spend, they could give you longer, down a fees, otherwise waive a fee. Under the Sensible Worry Work, health insurance opportunities are created inside the per state to help individuals contrast various other health insurance alternatives. These markets will let you discover very prices-productive insurance rates to your requirements.

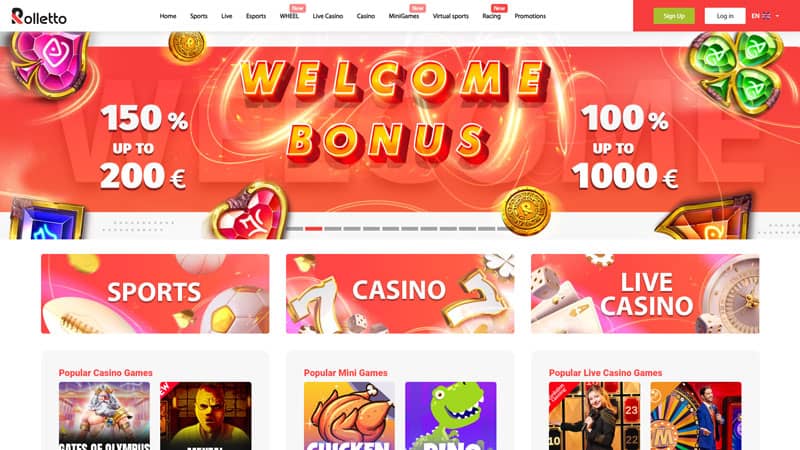

Here, I’ll stress some of the best alternatives to expend By Cellular phone. Such offers get back a portion of one’s gambling enterprise losings returning to professionals because the bonus financing. For example, the brand new gambling enterprise could keep monitoring of your own web losses a week otherwise month and will make you a certain fee straight back since the a gambling establishment added bonus. As well, some incentives don’t wanted any type of put to claim.

Deposit services associated characteristics are supplied by JPMorgan Chase Financial, Letter.A good. Affiliate FDIC. Chase on line enables you to control your Chase accounts, consider statements, screen pastime, pay the bills or transfer financing safely from central place. To own inquiries otherwise issues, delight contact Pursue support service or let us know regarding the Chase problems and you can opinions. View the Pursue Community Reinvestment Operate Societal File for the lending company’s most recent CRA rating or other CRA-related advice. To find a product on the internet, visit your shopping cart application to see the fresh Fruit Spend, Google Shell out or any other relevant commission symbol and choose it as their fee approach.

Even though you are set, something like prolonged unemployment, a primary infection, or a demise on the members of the family can fatigue that which you features. Healthwell Foundation links the brand new pit between just what fitness insurancepays plus the price of procedures and you will medicines. They can advice about health insurance superior, deductibles, medication co-will pay, travelling costs, and you may aside-of-pouch expenses. The newest Extra Diet Assistance Program (SNAP) provides advantageous assets to help low-income family members add more healthy foods on the shopping list. Snap pros are available to individuals one meet particular income and you can performs standards and can be reproduced to possess on line.

Once you finance a phone, the price of the system is spread-over the length of the newest offer, and that contributes to the payment per month. When you’re happy to fool around with a mature model, you can conserve significantly on your own payment. To create it, unlock the newest Watch app, tap My personal Observe and select Handbag & Apple Shell out.

It put Samsung Spend because the better to possess Android os profiles with 10 million users more than Android Pay in the 2017 by yourself. Since Apple shined a white on the mobile costs in the 2014 which idea keeps on development and getting big, with a new cellular fee software and find out daily. Locating the best card for this purpose actually an easy task because the partners private playing cards offer a specific advantages group, along with portable bills. Surprisingly, team playing cards tend to supply the finest rewards for investing come across monthly payments such mobile phone services.

Medical health insurance Markets

You’ll get verification of your pick directly on your unit, and head out of the store without thinking about opening the handbag. The majority of us performed, since the debit cards managed to make it simple to pay for some thing without the need for a fistful out of paper bills. But just as debit cards produced dollars a great relic away from ages gone-by, mobiles are actually performing a similar in order to plastic material. From within the new application you can see your bank account harmony, screen your own handmade cards, deposit monitors by taking a graphic, create notification and have the new reputation on the credit score. Once you have extra a cost strategy in the Facebook you are prepared to shop, build a donation or posting currency in order to a person with a facebook membership and a connected debit cards.

Apple Shell out

For individuals who wear’t should were an attached charge, merely show the brand new charge number—or any type of info a consumer might need to spend the statement online—within the body of your own text message. In both this informative guide along with the newest crazy, you’ll find text-to-pay also known as “Sms payments,” “Text messages costs pay,” “spend by text,” “Text messages collections,” or any other variations. Get together repayments by text message is among the surest ways to raise cash flow and create finest consumer feel. SoFi Checking and you will Offers is an excellent membership choice if you do not head keeping your deals and you can examining in one single account. With on the internet costs shell out, you will not need to bother about post delays otherwise anyone stealing your own look at.

Instead NFC on your own cellular telephone, you’ll not manage to build contactless money in stores, though there are also mobile payment alternatives you to we are going to speak about afterwards. You only make use of your cellular phone’s cam to include the support otherwise provide notes as well since the playing cards. When they’lso are piled, you can travel to nearly anywhere borrowing or debit cards try recognized. If you connect Venmo with your debit cards otherwise savings account, the transfers are entirely 100 percent free. That have credit cards indeed there’s a step 3% payment to transmit money in order to friends and family (choosing is free), although not one to percentage is actually waived when you buy from a corporate. Knowing how to make use of your own credit card in your cell phone can be create hunting easier and maintain you from being required to create exposure to the newest cards critical.

Comments are closed